This month we are focusing on building an initial budget, understanding all the different bits of information that go into it, and how we can make it work for us in the future. The best way to see the process is to watch it in action! See how Elvis takes the first steps to financial stability below.

Elvis is 22. He’s been working at Jamba Juice for a couple of years and going to community college, but he really doesn’t feel like it’s for him. He loves playing his guitar and singing, especially whenever he can get on stage. He wants to start making some changes in his life but he feels like he is always out of money. He doesn’t even really know where all his money goes every month. Today, he only has $1147 in his account, but rent is due tomorrow and he somehow has to make that $147 last the whole next week, and he’s pretty sure his credit card payment is coming up! Elvis is tired of having this happen every month.

Elvis finds this super cool financial coach, Heather, and she tells him that the first thing he needs to do is look back at his spending last month. He is totally not a fan of this idea. He knows he spent too much, but it’s not like he can go back and “unspend” it now! Alas, she insists.

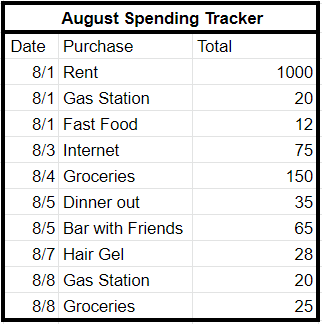

Elvis mostly uses his debit card for everything, so he can just look at his transaction history at his bank. He did the whole month, but the first week looked like this:

Heather told him to put every time he swiped his card into one of these categories:

- Gas category would include gas, tolls, car washes, etc.

- Groceries can cover all household needs, including food, cleaning supplies, hygiene items, and routine clothing purchases like replacing socks and underwear.

- Dining Out would include lunches at work, dinner with friends, even vending machine purchases, pretty much anything that isn’t Groceries.

- Entertainment is another catch-all, to include trips to the movies, concert tickets, even books and videogames and movie rentals.

- One-Time Purchases are when some items that don’t fit into a normal monthly category, such as a once-a-year oil change that will mess up your Transportation budget, or perhaps a shopping spree for a wardrobe upgrade due to a new job. Those items would be set aside as One-Time Purchases, and you will begin planning for these in your budget in the future.

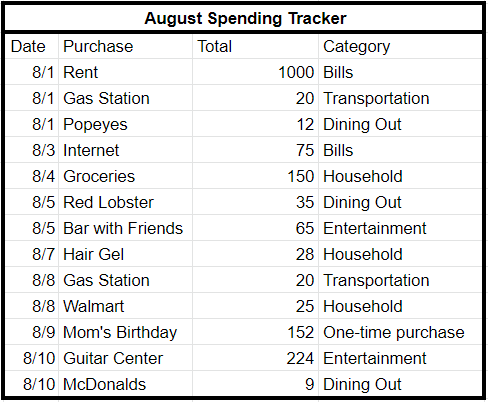

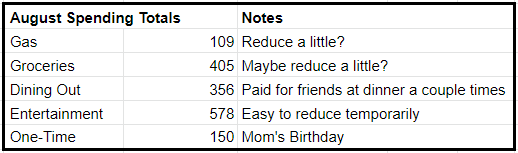

Elvis was able to mostly do that, but he decided the $150 he spent on his mom’s birthday gift wouldn’t really fit in any of those categories, especially because it’s not something he would buy outside of the special occasion, so he kept it separate as a One-Time Purchase

After reviewing his purchase history, Elvis realized he spent a lot of money on dining out and entertainment that he doesn’t feel too good about. I mean, yeah, he’s stoked about the new guitar pedals he got, but he feels like maybe he shouldn’t have spent that much spontaneously. Then he went back and got that new amp on sale… that was totally 100% worth it, but he could just not go to the guitar center for a month or so. He also was surprised to see how much he spent dining out, he didn’t think he really went to fast food restaurants that often. Some people go way more often than he does.

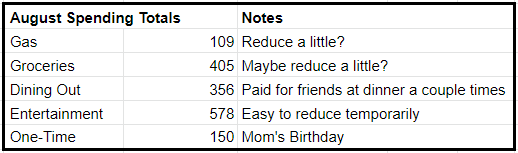

His August Spending totals looked like this:

So, why would he do all this? “Just spend less money,” seems like pretty obvious advice, right?

Heather thinks its stupid advice. Spend less money on what? Spend less when? How much less? And WHY would you want to spend less in the first place?

So you can put money toward your goals!!!

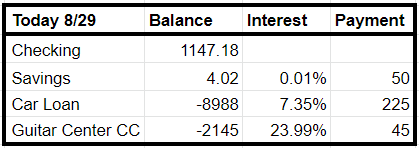

Heather asked Elvis, “What’s going on with your finances, dude?” She made him figure out the log in information on all his accounts and get actual balances for everything. She already knew he had a credit card, but she made him dig for details on all his accounts.

Looking at this, Elvis was astonished to see that his credit card interest rate was so high. I mean, that beautiful Taylor Acoustic/Electric is his baby. Totally worth it. He just wants to pay it off ASAP! Fair enough, dude.

Heather asks Elvis, “What else do you want? What do you drool over in the shops? Obviously you can never have enough guitars, but you just bought the Taylor, so you can probably restrain yourself for a little while. What do you think about when you see yourself with everything you want?”

Elvis mulls it over for a little bit. Finally he replies, “I see myself with a gorgeous guitar, playing on stage with perfect hair, a glittery cream-colored suit, and some awesome blue suede shoes. I’ve always wanted a pair but they’re expensive, and everybody always says it’s a silly thing to spend money on.”

Heather’s eyes light up. What an amazing image. “This is perfect! We can totally make this happen. We’re putting blue suede shoes on the list!”

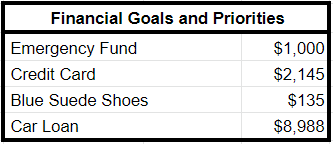

As the financial counselor, Heather recommended getting Elvis to financial stability first, and then to reward such an awesome accomplishment with the perfect pair of blue suede shoes. She proposed an initial emergency fund goal of $1000, a nice round number that would cover rent in the event that he lost his job one day. Then, that credit card is really the biggest thing. “With such a low payment over such high interest, it’ll take well over 10 years to pay off if he never pays extra and never use the card again. So that’s the next priority. Once the card is paid off, save up for the shoes! After that, focus on getting that car paid off,” Heather proposed. Elvis agreed, but he has his doubts about his abilities to actually save up that much money. Heather said “Shhh! You’re getting ahead of the program, we will get to that!”

So now, Elvis has financial priorities! This is super cool because he doesn’t have to think about what to do with his money anymore. Each time he gets paid, or gets any other income like from performance gigs or tax refunds, he puts that extra money toward his first goal.

But this is not the end! A couple more steps.

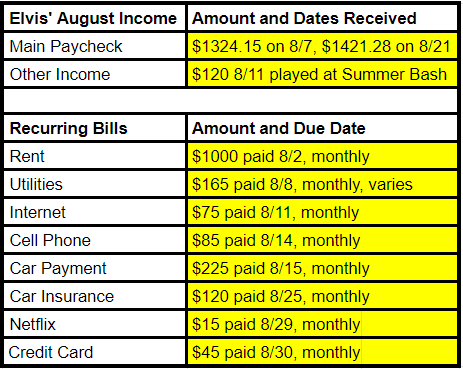

So now that we’ve got goals, we have a reason to reduce our spending. The first and foremost goal is paying rent and making it to the end of the month. Elvis suspects there’s a credit card payment due, but he’s not sure when or how much off the top of his head. First, he is instructed by his coach to record all the bills paid between August 1st and 31st.

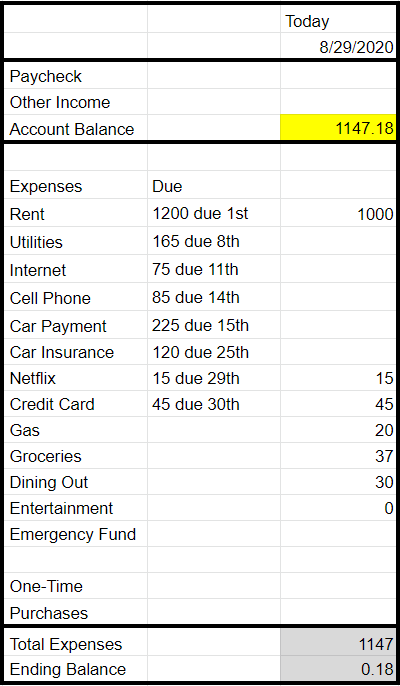

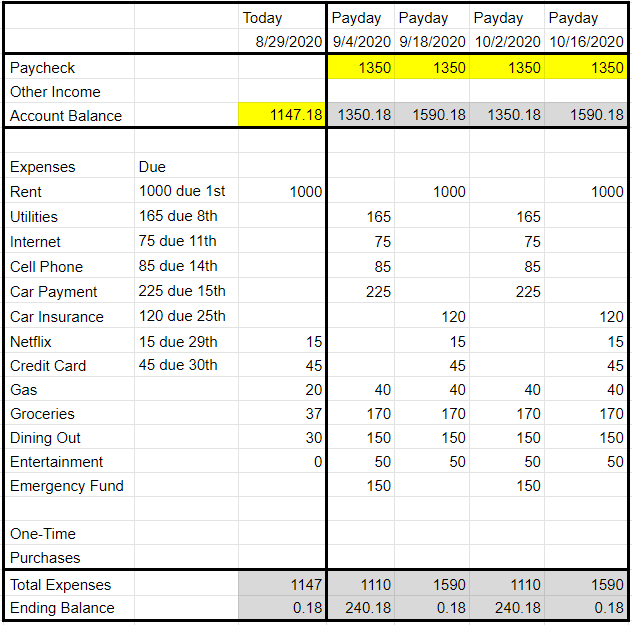

Once he has recorded everything he is responsible for along with the amount and the date it was due, he can finally start filling in the budget spreadsheet! For today, go back to the spending tracker and see what’s coming up between now and next paycheck. Enter those in under today’s balance in your checking account, and then as long as you keep that bottom number above $0.00, you can put the rest of the money toward your spending categories.

It’s gonna be tight this week! With Rent, Netflix, and the Credit Card payment coming due, Elvis has $87 to last him the next 6 days.

Heather says, “that’s okay, its just one week, you can do it! Get creative in the kitchen, and when you get bored, invite some friends over for a BYOB band jam session, or maybe have a movie night at home with whatever snacks you can scrounge up from the pantry! You got this.”

Heather sets up another session with Elvis on his next payday, September 4th. Elvis is set free into the world to go manage himself for the rest of the week.

When Elvis returns on payday, Heather is excited to start fresh with a paycheck. “This is where the magic happens! Review your spending for the week, reflect over how each category felt, and think about items you really wanted or needed to buy, but put off because of the tight budget. Now we set “normal” spending budgets.”

Referring back to last month’s spending, Elvis says he really likes to cook and would like to focus on cooking at home more. Since last week was so tight, he tried a couple of new recipes from what he had around the house and only had to buy a couple of ingredients. He also really enjoys the social aspect of dining out with friends, but he thinks he can cut back on what he spends per session.

Heather thinks this is an excellent idea and that he should experiment with reducing his dining out spending by about 15%, and see if he can be more mindful about his grocery spending for the next two weeks, possibly reducing that by about 15% as well. Transportation costs will likely stay the same but the majority of his entertainment spending was on music stuff and Elvis sheepishly admitted he can probably stop buying stuff at the Guitar Center for a couple of months since he has everything he really needs. He decided to allow $50 every two weeks to spend on entertainment, going to concerts and movies with his friends and not shopping.

Now it’s time to put it all together! In the spreadsheet, Heather shows Elvis where to enter his income information and how to align his bills with whichever paycheck they will come from.

Heather shows him how the decrease in spending even at moderate levels can save him $150 per month, which he can put toward his first goal of saving a $1000 emergency fund. At this rate, He will have his emergency fund filled up by February and will be able to start shoveling extra money toward his credit card. Heather reminds him, any birthday money, over-time, gig money, money friends pay you back, and of course, money you don’t spend, can all go towards achieving your goal even faster.

Heather proudly exclaims, “Elvis, meet your new zero!”

The spreadsheet carries forward so that Elvis can make sure that he has enough money to get through rent every payday, and doesn’t have to use his credit card or pull from savings. Under the column for the 9/18 paycheck, at the very bottom, Total Expenses is actually higher than Elvis’s anticipated paycheck, so he will need to make sure that the ending balance under 9/4 is at least $240 BEFORE his 9/18 paycheck comes in, in order to pay all his bills. So, $240 is his new $0, so he knows he can’t spend any more.

This sounds dramatic at first, but actually a lot of that is negotiable. Heather showed him how to set the budgets for each category, but those are only guidelines. If he needs to spend more in one category he can reduce from another category, or if he has an unexpected expense, he can rearrange his spending habits to accommodate it.

“It takes a few months of practice, but once you have some emergency fund to work with, it becomes much easier,” Heather reassures him. She will continue meeting with him every payday for the next 4 months to help him adjust his budget so that he is comfortable in his new spending habits and knows how long it will take to reach his goal.

This is what financial coaching is all about! It’s not just about telling people to spend less money, and we definitely don’t want you to feel bad for purchases you’ve made in the past or any other financial decisions you may not be proud of. At Financial Stability Experience, we deeply believe that you should never feel guilt or shame about your financial situation, but you should have the knowledge about how your decisions affect your future. We strive to show you what your money can do for you.

If you or someone you know would like to talk with financial coach Heather, the founder of FSE, about your goals, you can set up a free consultation here!