Resources

This page is a collection of the resources I use with my clients to help simplify their journey to financial stability. I add new content as often as I can, so make sure to check back for more!

Featured Articles

When money is tight, the very first step is to become extremely honest with yourself. You have to lay it all out so you can see it at once. Here’s a guide to getting started!

I get this question all the time! I think oftentimes, people are looking for some indication that they are on the right track. Good news! The fact that you’re asking is a sign that no matter where you are with your financial situation, you are ready to get to the next level.

Have you ever looked at your credit score and thought, what does that even mean? Is it good? Can I fix it? Here’s an explanation of the 6 factors that affect your credit score, and how you can make them better!

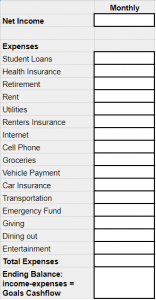

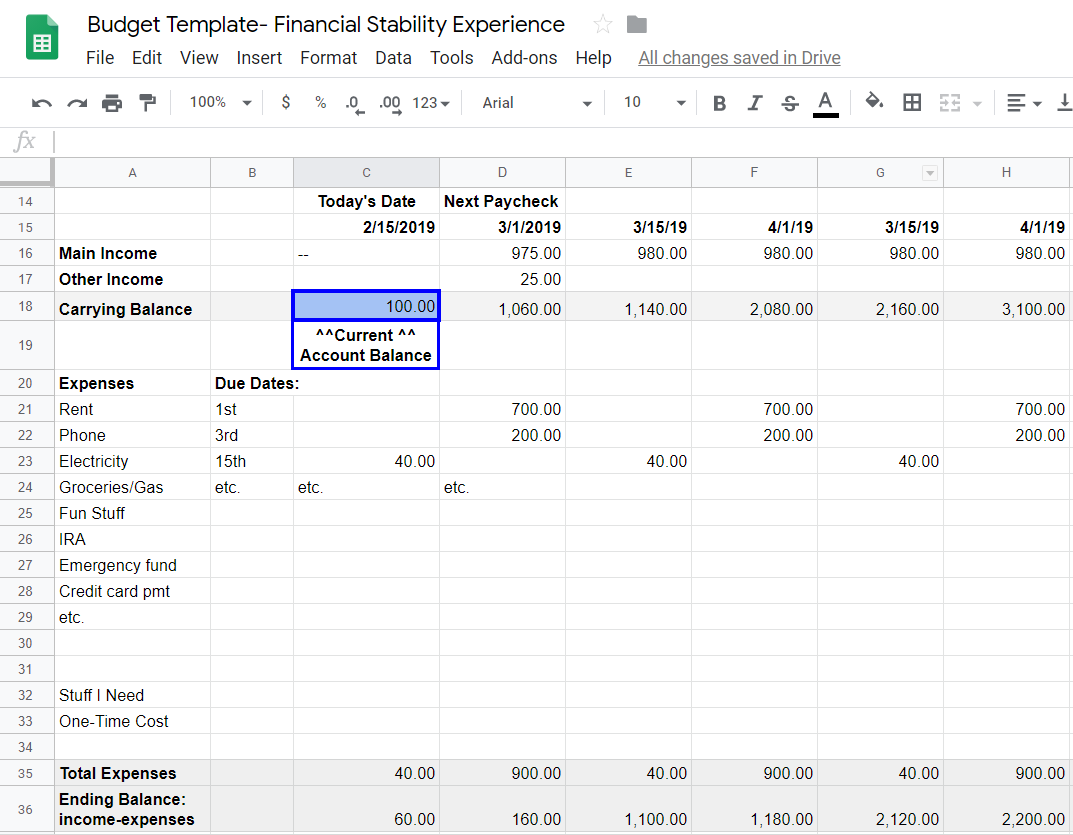

Budget

-

The paycheck-to-paycheck solution to breaking the paycheck-to-paycheck cycle!

This is the link to the budget spreadsheet I use with my financial coaching clients. When you make a copy it is 100% adjustable and designed to grow with you throughout life's changes.

You can include regular income and unanticipated windfalls, you can add lines for expenses and new goals. You can track every penny or allow yourself a comfortable buffer.

You have all the power to make this budget work for you no matter where you are in life, or where you are going.

Book Reviews

The Simple Path to Wealth by J. L. Collins is, hands-down, the best book for beginner investors who just want to ensure stability in retirement.

The book outlines the different purposes for saving, the different tax-advantaged accounts available, and the different types of securities a person can have access to. Anyone can understand and apply the information presented in this book to their own retirement accounts and become more comfortable with their financial futures.

This book is not just about money. It’s about adulting. It’s about how to be, and how to FEEL like a productive member of society. It’s about learning how to take care of yourself and how to be confident in your decision making.

The book is divided into chapters on Budget, Investing, Career, Food, Home, Love, and Action. Throughout each chapter she consults other experts, and provides references and resources, and tons of tips and tricks.

This book is about designing your ideal life. It’s about identifying what you want your day-to-day, and month-to-month, and year-to-year life to look like. She asks awesome questions, gives great examples, and is so encouraging about building your dream life.

If you’re looking for something to really drive those dreams of financial independence to the front of your mind, and keep them there, this book is perfect.

Kristie is the ultimate conservative when it comes to risk tolerance. She grew up in rural China and is deeply familiar with what scarcity really means, and when she and her husband began considering financial independence and traveling the world, they used their engineer brains to develop a system that addresses every possible risk and keeps them feeling as safe as possible. If you’re a skeptic, you’ll LOVE this book.

This exercise is designed to teach young adults what to expect from their future salaries and how to live within their means. It should take about 20-30 minutes, but one can play with the scenarios as much as they like. We chose 5 potential career paths that will allow a wide range of opportunities with different pros and cons for each. We also provided some options for living arrangements, transportation, and lifestyle.

We believe that every person deserves the opportunity to make informed decisions about their life choices, and this course will help young adults learn what they value most and where they have the ability to compromise. The key to successful financial planning is looking into the future!

More Tips And Tricks!

A debt repayment plan isn’t a trademarked, specific formula. It’s simply the plan that you make to change your life. Here are some options for you to choose from to make the best plan for your life.

Different finance professionals have different views on credit cards and I think that has to do with their audience. I prefer to give people the information to make their own choices, rather than making a blanket recommendation.

Consolidation loans are a great idea in theory. If you have a high balance of debt with high interest rates, it may be a good idea for you. If you are considering this option, here’s how to do it successfully.

Here are some ways that you can reduce your recurring expenses that you may not have tried before, I bet you’ll find at least one that you can implement in your life today!